Superintendent Press Release December 16, 2022

Dear Cedar Bluffs Families,

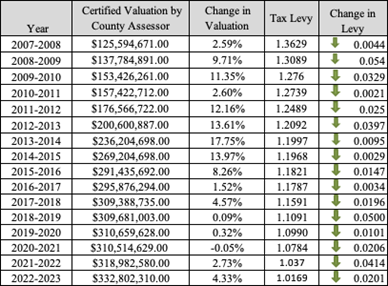

Like many of you I received my tax statement for 2022 in the mail this week and wow. Just wow. Even though as a school we have lowered our levy each year for the past 16 years in a row, we have not been able to lower it enough to keep pace with assessed values. My home went up $62,000 in assessed valuation in one year which would have required a massive drop in all levies. The school sets its budget off expected needs for the year and like all of us with inflation, prices have risen, salaries, insurance, retirement and just everything has risen and yet we were still able to lower our overall levy by 2 cents. The school has no control over assessed valuations as they are set by our county assessor and really all they are doing is looking at recent sales of similar property located near your property to set those values.

CEDAR BLUFFS SCHOOL

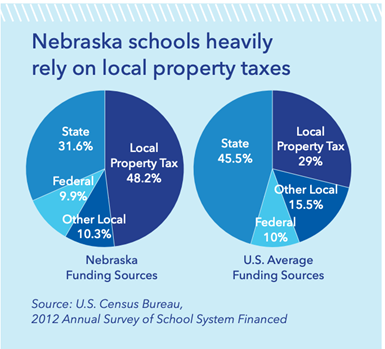

The Nebraska Legislative Fiscal Office has projected that valuations will continue to rise 5.58% in 2023 and 7.5% in 2024. In November of 2022, farm ground in Sheldon and Boyden County of Iowa sold for $30,000 per acre and a month before a farm ground in Plymouth County Iowa sold for $26,000 an acre. Guess what the properties around those sold will be valued at, next time valuations are set? I recently attended a meeting hosted by Open Sky institute, which is a non-partisan organization that advocates for a strong Nebraska through clear fiscal research and analysis. A couple of things that resonated with me from that meeting. Nebraska ranks 49th in Nation for funding to public schools, which means that schools rely heavily on local property taxes. Most States, like Nebraska rely on a 3-legged stool of taxation from sales taxes, income taxes, and property taxes. But in Nebraska, the 3 legs are completely out of balance with property taxes making up close to 50%. The illustration below comparing Nebraska to other States is from 2012 and it has only gotten worse.

Last year the Nebraska Legislation bragged about passing the largest tax cut in history. And while this is true, LB 873 gives huge tax cuts in INCOME TAX, which does nothing for property tax relief. As a matter of fact, most of the cuts where tailored toward Corporations lower their bill from 7.5% to 5.84%. This will only compound the 3-legged stool imbalance. Sales tax have continued to fall too, with more and more exemptions being granted. Did you know there is an exemption for a Nebraska resident who buys a private jet in Nebraska, but parks it in another State as long as they fly out of the Nebraska, just once, within the first 10 days they own it, they don’t have to pay sales tax (motor vehicle tax), like you or I, if we buy a new vehicle. Open Sky also informed us that Nebraska currently has a budget surplus of $1.7 Billion and projects that to rise to $2.3 Billion by June of 2023. Billion is a hard thing to contemplate and saying someone has 1 million versus 1 billion doesn’t sound like a big difference; but they said think of it like this. If you equate money to time: if you had 1 million dollars that would equate to 11 days in time but if you had 1 billion that would equate to 32 years. A significant difference and with corporations seeing record profits these past 3 years the United States now has 735 Billionaires. China has the 2nd most with 539. The rest of the World has 679 combined. Lastly, if you have been following my press release don’t forget about LB 1107. This is a refundable income tax credit on the property tax that you have already paid. You must claim this credit when you file your taxes. Rather than just decreasing the property tax you pay by giving more money to schools through the State Aid formula, the legislation thought it was a good idea to make your ask for your money back. To date only 60% of taxpayers have done this. In 2020 you could get back 6% of the property taxes you paid. Last year it jumped to 25.3% and this year they are anticipating even more because of the large cash reserve at the State level. Nebraska needs an updated model of taxation, and an improved way to fund public schools. The 3-legged stool is about to topple over.

This will be my final Press Release for 2022. Have a very Happy Holiday! #Wildcat Pride!